8:30 am. Garden kittens have stormed the house and laid claim to my bed, ruffling around playfully between the sheets. I haven't the heart or energy to chase them out. Fresh coffee in hand fails to disperse sleep from my eyes as a I plan the day ahead:

Tomorrow I need to finish most of the branding work on PROJECT FUNNYCULT, run a couple errands, including a much-dreaded Ikea run. I'd really hoped to avoid Ikea upon the move to Cairo, which I hoped to avoid upon the move to Cairo, but I don’t have the time or patience to comb through the city’s endless shopping clusters for a couple of basics. A negligible betrayal only if it were my first since being here.

RESTRICTED FREQUENCY #225 goes out around midnight. Its title: Anything But The Art! 😱

#journal #work

Grants, residencies, and open calls for artists:

#Grants #Radar

“Write to entertain yourself first. Because if you’re bored, your reader will be bored too. This applies even to client work with specific briefs and notes you may not actually agree with. Find a way to keep yourself interested and engaged and it’ll reflect in the work. Pander or try to write for an imagined audience and it will show.”

From 12 RULES FOR WRITING by Warren Ellis via his ORBITAL OPERATIONS newsletter.

“Write every day, but set a minimum boundary. Graham Greene only wrote 500 words a day. Some people set ten minutes of full focus a day. Putting your body in front of word-making materials for a period of time is the thing, and if that ever seems hard to you, think about Jean-Dominique Bauby, who had to dictate an entire book using only his left eye to signal with. Books are written only by the people who show up to write them, even if it’s only ten minutes a day.”

Also: “Always know when to leave the stage and what to leave behind.”

Many great tips from an expert in the field who's been around long enough to give it to you straight.

#radar

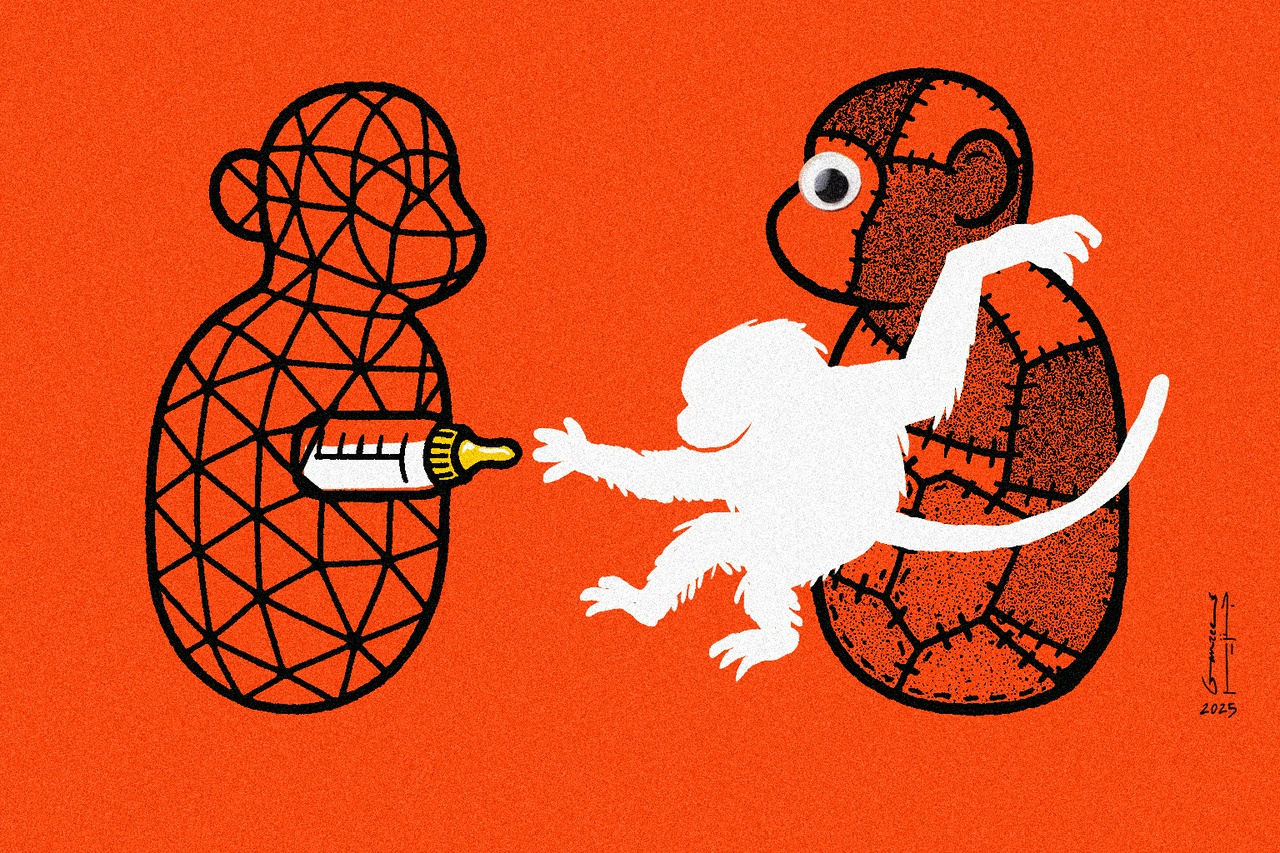

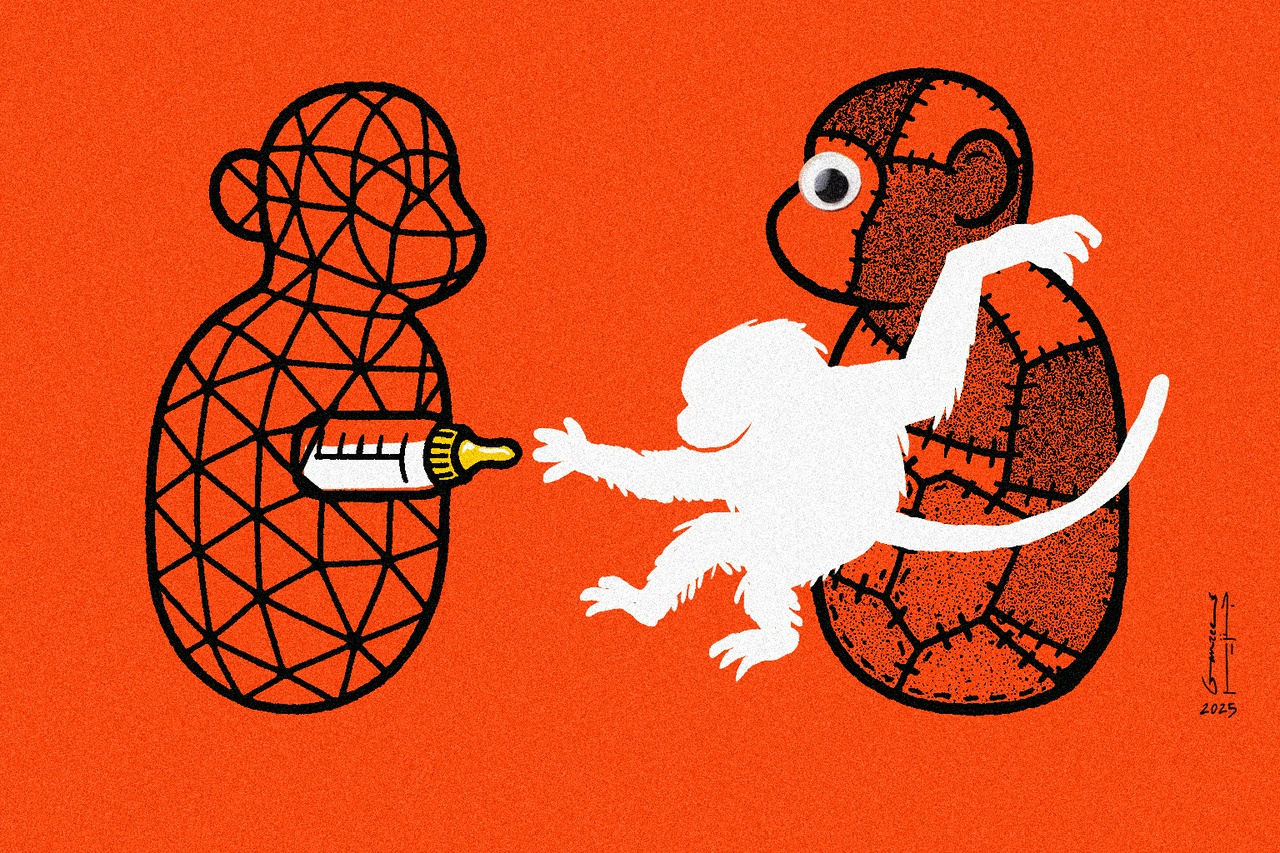

“Sometime around 1957, in a fluorescent-lit lab at the University of Wisconsin, psychologist Harry Harlow carried out a study that would come to haunt the field of behavioral science.”

From RESTRICTED FREQUENCY #224: False Monkey Theory

“The experiment, which would be difficult to receive grant approval for today (for good reason at that), involved separating newborn monkeys from their mothers just hours after birth (evil!). The infants were then placed in solitary confinement with two ersatz 'mothers'—one, a minimalist wireframe fitted with a bottle of milk; the other, soft and wrapped in fabric, but offering no sustenance...”

#RF

Two belated additions to the new studio that are difficult for me to function without: a wall clock and notice board!

Small victories can be so satisfying sometimes.

#journal #studio #cairo

The next RESTRICTED FREQUENCY is scheduled to drop on Sunday. In it, we draw on a chilling monkey experiment from 1957 to illustrate how comfort is often sought after over truth—nationalism, corporate “families,” and expat illusions are all explored within. Plus: a poster giveaway, smoothie recipe, and sharp cultural picks.

An issue not to be missed! If you haven't already, sign up now to make sure it lands in your inbox and makes it in front of your eyeballs.

#RF